Dear Readers,

This assignment required us to analyze economic theories of the Great Depression. With an event like this which led to so much hardship for so many people, it is understandable that there are multiple theories behind the Great Depression. In his article “The Great Depression as Historical Problem,” Michael Bernstein writes that traditionally, scholars of the Great Depression have identified three causes; the Stock Market Crash, policy errors, and long-term factors. He states that the more recent scholarship tends to suggest that the true reasons for the duration and severity of the Great Depression lay not in the stock market crash itself, but rather in long-term factors that were a sort of ripple effect after 1929.

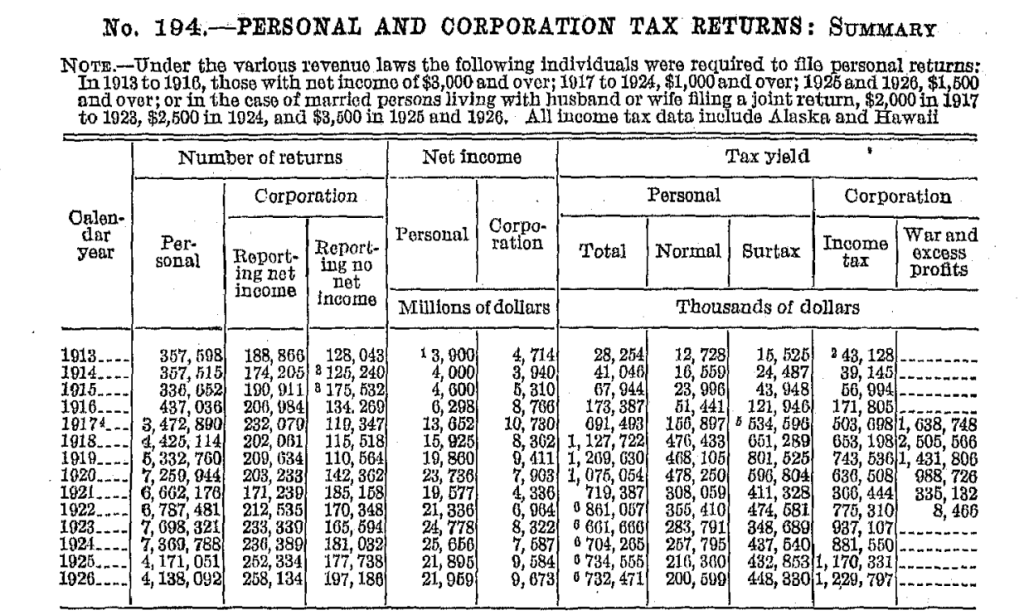

With this in mind, I turned to the Statistical Abstract for 1929 and for 1933. Interestingly, the government did not publish an abstract for 1932. Rather than looking at stocks or bonds, I decided to look at personal income taxes as reported in these two abstracts to see if they reflected what was going on in the country as a whole. I’m not an economist, or an accountant, but I theorized that as the workforce took a hit, as did personal savings during the Depression, it would have an impact on the number of people filing personal income taxes. When you look at long-term factors, the lack of income, or the reduction of income, has an effect on spending, and spending has an effect on the economy as a whole. Consider, for example, in the Spring of 2020, as everything shut down, the economy went into a tailspin. The President, and Congress, sought to tackle this from multiple angles, from giving loans to businesses to giving direct stimulus payments to the people, with the hope that they would then spend that money locally help local businesses stay afloat. With the unemployment rate climbing, putting money into people’s pockets, in theory, would decrease foreclosures, etc.

The first abstract I looked at was from 1929. In it, you can see the number of returns filed between 1910 and 1926. The number of returns filed peaked in 1924, and dropped the following two years by three million. However, as this was prior to the crash, this would not have been due to the Depression. On the righthand side of the table, we can see that even as the total number of returns filed dropped significantly, the tax yield of those returns continued to increase. In other words, less people were filing, but they were paying more in taxes.

In the second abstract from 1933, we can see that the overall downward trend continued from 1927 through 1930. Not only that, but the net income dropped significantly from 1928 to 1930, from $25,226, 237 in 1928 to $18,118,165 in 1930. This hast to be due to the crash in 1929, and the ripple effects on the economy, specifically the bank failures, which wiped out people’s savings. At the same time, regular taxes paid went down by almost 50% from 1928 to 1930. Capital Gains were decimated, dropping from $284,645 in 1929 to $65,442 in 1930.

What can this data tell us about the US economy during the Depression? At least from a tax standpoint, fewer Americans were paying taxes in 1930 than had in the previous years, though this is part of a downward trend that started prior to the crash. However, the amount of money being paid in taxes dropped significantly from 1929 to 1930. It is likely there are a variety of reasons for this. On the one hand, with the economy starting to contract after the crash, leading, eventually to bank failures and unemployment, this would have an impact on those required to file taxes. It is also possible that this may be more due to specific effects in certain regions of the country. It would be interesting to look at unemployment and tax data by region to see if this was across the board, or if it hit certain places harder. Also, as people found themselves with less income, and/or unemployed, this no doubt began to take a toll on the local economy, as people had less disposable income to spend. Local stores and businesses, faced with a sudden loss of customers, would have to respond by laying off some workers, or closing altogether, which would add to the drain on the local economy.

Looking back on March through May of 2020, it now makes sense to me why the government quickly moved to try and shore up the economy. They remembered what happened in 1929, and realized that, absent direct intervention in 2020, we might face the same type of situation. While the economy still got hammered hard in 2020, government intervention just might have kept us from having a protracted depression like we experienced after the stock market crash in 1929.

Regards,

BLH